Ontario’s Housing Market in 2025: A Cooling Trend Across Regions

The Ontario housing market is experiencing a significant shift, with declining sales, rising inventory, and legal disputes highlighting the challenges faced by buyers, developers, and builders.

Legal Battles in Toronto’s Condo Market

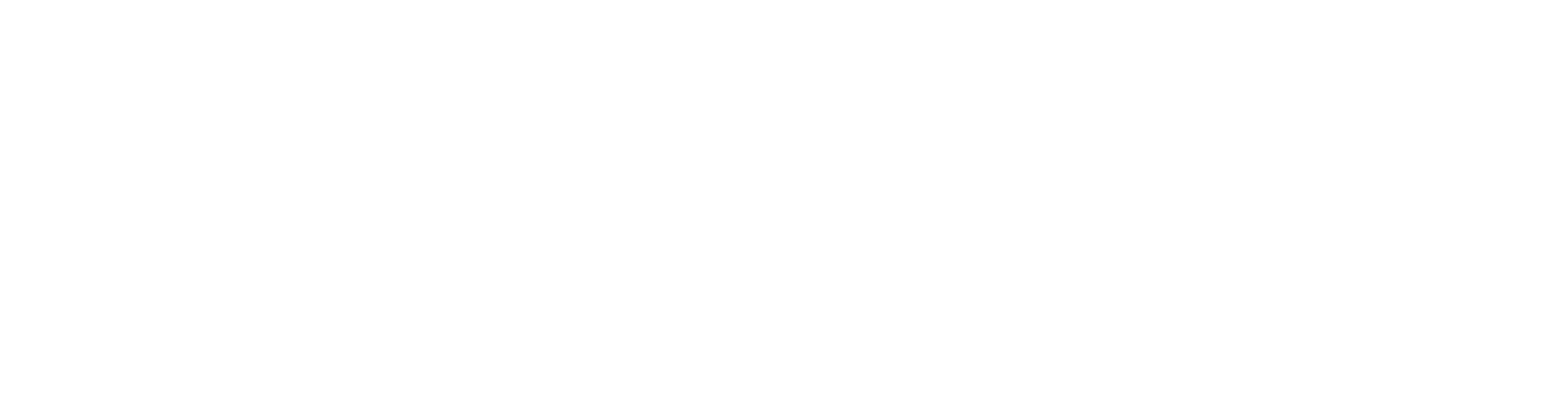

Toronto developers CentreCourt and Mod Developments have filed nearly 130 lawsuits against buyers who failed to close on pre-construction condo units. These buyers, many of whom were investors, placed 10% deposits on studios priced over $800,000 but are now being sued for damages exceeding their deposits. Falling appraisals—down 10% to 30% from original purchase prices—have created financing gaps that buyers cannot bridge due to higher interest rates. This situation underscores the risks of speculative investments, as many buyers relied on assignment flips rather than long-term ownership or financing capacity. With record completions in 2024 and 2025 flooding the market, prices continue to decline, challenging the assumption that “real estate always goes up.”

Record Low Sales in the GTA

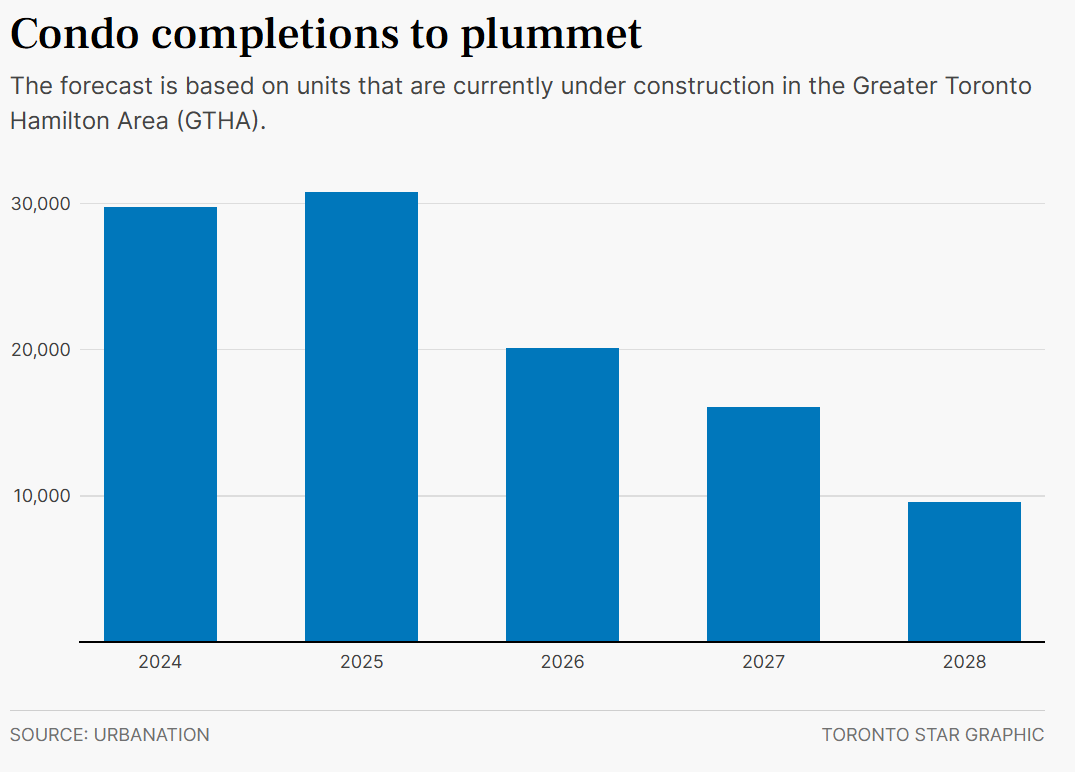

February 2025 marked the worst February on record for new home sales in the Greater Toronto Area (GTA). Only 400 new homes were sold, an 84% drop from the 10-year February average of 2,570 sales. Single-family home sales fell by 38%, while condo sales plummeted 62%. Inventory rose to 21,863 units, representing a 14-month supply, further emphasizing the cooling market.

Waterloo Region: High Inventory and Slowing Sales

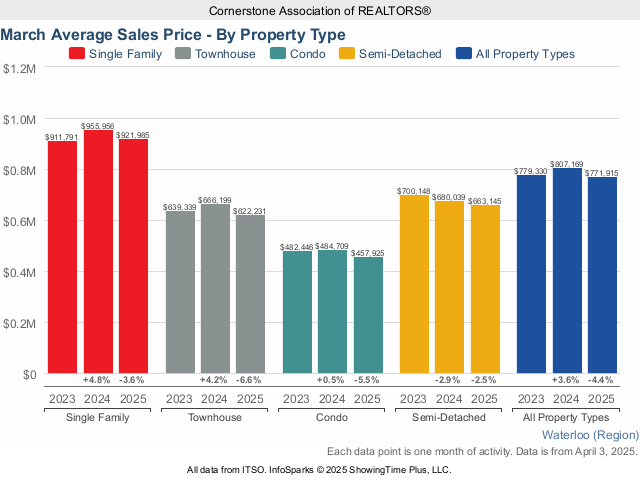

The Waterloo Region is also feeling the effects of a cooling market. In March 2025, 459 homes were sold, a 23.1% decrease compared to March 2024 and a 45.2% drop from the 10-year average for the month. Inventory levels reached their highest point for March since 2015, providing buyers with more options and time to make decisions. Detached homes saw a 24.7% decline in sales, while townhouses and condos experienced drops of 24.0% and 29.4%, respectively. Interestingly, semi-detached homes saw an 8.1% increase in sales. The average sale price for all residential properties in the region was $771,915, a 4.4% decrease from March 2024.

Why It Matters

These trends reflect a broader shift in Ontario’s housing market. For buyers, the increased inventory and slower sales offer opportunities to make more informed decisions. For developers and builders, adapting to changing market dynamics is crucial. Speculative investments based on unwavering price growth have faced tough lessons, as higher interest rates and an oversupplied market reshape the real estate landscape.

Ontario’s housing market in 2025 serves as a reminder that strategic planning and realistic expectations are essential in navigating these challenging times.